AI in Trading: Boon or Bane? Unveiling the Rise and Risks of AI-powered Trading Apps

The allure of artificial intelligence (AI) has permeated the financial sector, with AI-powered trading apps mushrooming and attracting investor interest. While AI holds immense potential to revolutionize trading through data analysis, pattern recognition, and algorithmic execution, it’s crucial to be aware of the evolving landscape of scams that exploit this very technology.

How AI is Transforming Trading

- Enhanced Analysis: AI algorithms can sift through vast amounts of market data, identifying complex patterns and trends invisible to human traders. This empowers investors to make informed decisions based on a more comprehensive picture.

- Speed and Precision: AI can react to market fluctuations in milliseconds, executing trades at speeds humans simply cannot match. This allows investors to capitalize on fleeting opportunities and minimize slippage (the difference between the intended and actual price of a trade).

- Risk Management: AI can be programmed to identify and mitigate risk factors, helping investors build more robust portfolios and avoid emotional decision-making during market volatility.

However, the very features that make AI-powered trading apps attractive also create fertile ground for scams. Here’s how:

- Unrealistic Promises: Scammers leverage the hype surrounding AI, promising guaranteed returns and minimal risk. Remember, the market is inherently unpredictable, and any app claiming to eliminate risk is likely fraudulent.

- Black Box Algorithms: Some apps shroud their AI algorithms in secrecy, making it impossible for investors to understand the logic behind their trades. This lack of transparency raises red flags and hinders investors from making informed decisions.

- Data Security Concerns: AI relies heavily on user data, making these apps vulnerable to hacking attacks. Investors should be wary of apps with lax data security protocols that could expose their financial information.

How to Spot a Scam: A Checklist for Investors

- Guaranteed Returns: Be wary of any app promising astronomical returns without mentioning the inherent risks involved in trading.

- Unregistered Platforms: Always verify if the app and the company behind it are registered with legitimate financial authorities.

- Unrealistic Backtesting: If the app showcases unrealistic backtesting results (simulated trading performance), it’s a major red flag. Real-world performance can deviate significantly from backtested results.

- Hidden Fees: Scrutinize the app’s fee structure for excessive charges or hidden costs that could eat into your profits.

The Reliability of AI-powered Trading Suggestions: A Balancing Act

The reliability of trading suggestions from AI-based auto trading features in major trading apps is a complex issue. While AI offers undeniable advantages, it’s crucial to understand its limitations and the potential for manipulation to create a fantasy element for attracting investors.

Factors Affecting Reliability:

- Data Quality: AI algorithms are only as good as the data they’re trained on. Incomplete, inaccurate, or biased data can lead to flawed suggestions.

- Market Complexity: The financial market is inherently unpredictable, influenced by a multitude of factors beyond historical data. AI can struggle to account for unforeseen events, black swan events (highly improbable yet impactful events), and sudden shifts in sentiment.

- Overfitting: AI models can become “overfitted” to historical data, leading them to perform well on past data but failing to adapt to changing market conditions.

The Fantasy of AI Trading:

Major trading apps often leverage AI as a marketing tool, painting a picture of effortless wealth creation through automated trading. This creates a fantasy element that can be misleading for investors:

- Ignoring Risk: AI suggestions often downplay risk, focusing solely on potential gains. Investors must remember that even the “best” AI can’t eliminate inherent market risks.

- Psychological Appeal: The illusion of control and the promise of easy money can be psychologically appealing, leading investors to make impulsive decisions based on AI suggestions rather than thorough analysis.

- Omission of Human Expertise: AI lacks the human capacity for experience-based intuition and emotional intelligence, which can be crucial in navigating market complexities.

Finding the Right Balance:

It’s important to view AI as a tool rather than a crystal ball. Here’s how to leverage AI responsibly:

- Confirmation, Not Automation: Use AI suggestions as confirmation for your own analysis, not as a substitute for it. Conduct thorough research and understand the reasoning behind the AI’s recommendations.

- Focus on Risk Management: Don’t rely solely on AI for risk management. Develop a robust risk management strategy and set clear stop-loss limits to protect your capital.

- Maintain Control: Ultimately, the investment decision lies with you. Understand your risk tolerance and investment goals before using AI features.

Recent AI Trading Scams and How to Stay Safe

While AI holds promise in the trading world, it’s also become a magnet for scammers. Here are some recent headlines that illustrate the evolving landscape of AI-based trading scams:

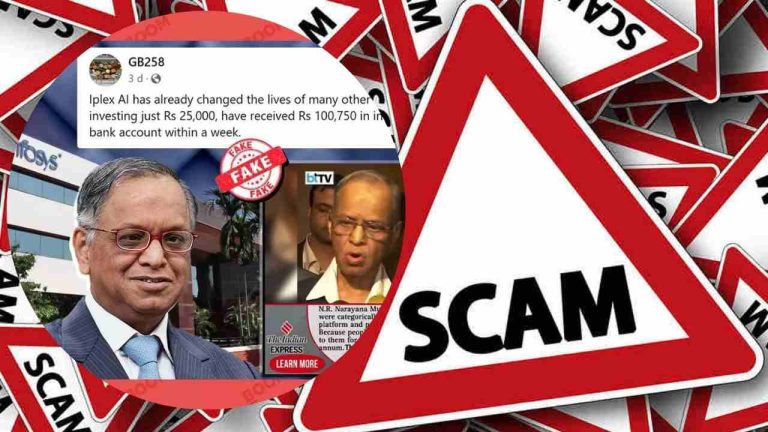

- Deepfake Fraud: Scammers use AI-generated videos (deepfakes) to impersonate financial figures, promoting fake investment opportunities or pump-and-dump schemes.

- Phony AI Apps: Fraudulent apps lure investors with unrealistic promises of guaranteed returns through their “proprietary AI.” These apps often disappear with user funds.

- Social Media Manipulation: AI is used to create fake social media accounts that spread misinformation and hype around specific stocks, driving prices up before scammers cash out.

Tips to Stay Safe from AI Trading Scams:

- Be Wary of Unrealistic Promises: If it sounds too good to be true, it probably is. Guaranteed returns and minimal risk are major red flags.

- Do Your Research: Before investing with any AI-powered platform, research the company behind it. Verify their registration with financial authorities and check user reviews.

- Beware of Black Box Algorithms: Avoid apps that keep their AI algorithms shrouded in secrecy. Transparency is essential for informed decision-making.

- Scrutinize Data Security: Ensure the app has robust security measures in place to protect your financial information.

- Don’t Fall for Deepfakes: Be skeptical of videos featuring financial figures, especially if the content seems out of character or the production quality is unusual.

- Question Social Media Hype: Don’t make investment decisions based solely on social media buzz. Verify information through credible sources.

Remember:

- Invest in Yourself: The best defense against scams is your own knowledge. Educate yourself on AI in trading, market fundamentals, and risk management strategies.

- If in Doubt, Opt Out: When something feels off, it probably is. Don’t hesitate to walk away from an opportunity that seems suspicious.

- Report Scams: If you encounter a potential scam, report it to the relevant authorities and financial regulators. This helps protect others from falling victim.

By following these tips and approaching AI-powered trading with a critical eye, you can navigate the financial landscape with more confidence and avoid falling prey to the latest scams.

The Future of AI in Trading: A Collaborative Dance with Untapped Potential

The marriage of AI and trading platforms presents a fascinating paradox. AI offers undeniable benefits – enhanced analysis, lightning-fast execution, and data-driven insights that can empower even novice investors. However, its limitations and the potential for misuse by bad actors cannot be ignored.

The key to navigating this landscape lies in recognizing AI as a powerful tool, not a magic bullet. Investors must prioritize responsible practices: conducting thorough research, understanding the limitations of AI, and employing robust risk management strategies. Regulatory bodies also have a role to play in establishing clear guidelines for AI-powered platforms and ensuring investor protection.

So, will AI trading apps pose a threat or benefit investors in the future? The answer hinges on a delicate balance. With responsible development, robust regulations, and investor education, AI has the potential to revolutionize trading.

However, the future may not be a binary choice between human and machine. Imagine a future where AI serves as a powerful co-pilot, providing valuable insights and streamlining execution, while human intuition and experience guide overall investment decisions.

This collaborative approach could be particularly significant in a market like India. Legendary investor Warren Buffet himself acknowledged the “unexplored opportunities” in the Indian stock market, fueled by the nation’s burgeoning startup scene. AI-powered tools could prove invaluable in navigating this dynamic and complex landscape.

Warren buffet

Ultimately, the future of AI in trading is in our hands. By approaching this technology with a critical eye and prioritizing responsible practices, we can ensure that AI becomes a force for good, empowering investors to unlock the potential of the Indian market and navigate the ever-evolving financial landscape with greater confidence and clarity.

Tech Trailblazers

Read more: The Dawn of AI Engineers: Devin and the Disruption Ahead | Cryptocurrency: A Double-Edged Sword for the Average Investor | SightBit: AI Lifeguard Tech Saving Lives on the Shores | Google’s Fitbit Gets Smart: Unveiling the Future of Fitness with AI-powered Coaching